Topic 2 → Subtopic 2.5

What is Price Elasticity of Supply?

Price elasticity of supply (PES) is a critical concept in economics that explains how responsive producers are to changes in the price of a good or service. Understanding PES allows businesses to anticipate how quickly they or their competitors can adapt to changing market conditions, providing a strategic advantage in dynamic markets. For policymakers, it reveals how supply-side constraints impact the availability of goods, particularly during shortages or periods of heightened demand.

In this article, we will explore the definition and calculation of PES, analyze its applications in real-world scenarios, and examine why it matters for understanding market behavior and planning effective strategies.

Defining Price Elasticity of Supply

Price elasticity of supply quantifies the responsiveness of the quantity supplied to changes in price. It is calculated using the following formula:

The resulting value reveals whether supply is elastic, inelastic, or unitary elastic:

Elastic Supply (PES > 1): Supply responds strongly to price changes. Even a small price increase can lead to a disproportionately large increase in quantity supplied.

Inelastic Supply (PES < 1): Supply is less responsive to price changes. Significant price increases result in only modest increases in quantity supplied.

Unitary Elastic Supply (PES = 1): The percentage change in quantity supplied matches the percentage change in price.

For example, imagine a farm experiencing a 20% rise in the price of wheat. If farmers increase their supply by 10% in response, the PES would be 0.5, indicating inelastic supply. On the other hand, if the increase in supply were 30%, the PES would be 1.5, reflecting elastic supply.

The degree of elasticity depends on a variety of factors, including the time producers have to adjust, the availability of inputs, and the characteristics of the industry. These factors determine how flexible producers are in scaling their output to meet market demand.

Applications of Price Elasticity of Supply

Business Strategy:

For businesses, understanding PES is fundamental to crafting effective strategies in competitive markets. Firms with elastic supply can take advantage of price increases by rapidly increasing production, capturing market share and maximizing profits. For instance, manufacturers with advanced technology and flexible production lines can respond to sudden surges in demand, ensuring they meet consumer needs while competitors struggle to adjust.

Conversely, businesses facing inelastic supply constraints may prioritize efficiency improvements or invest in capacity expansion to increase their responsiveness. For example, a small-scale vineyard might use increased revenues during a high-price season to invest in more land or equipment, improving its supply elasticity in the long term.

Market Dynamics:

PES also plays a crucial role in understanding market dynamics. In industries with elastic supply, producers can respond quickly to changes in demand, stabilizing prices and ensuring availability. For example, in the tech industry, flexible supply chains allow companies to rapidly produce consumer electronics during holiday shopping seasons, preventing significant price fluctuations.

In contrast, markets with inelastic supply often experience price volatility, particularly during demand surges or supply disruptions. This is evident in agricultural markets, where factors like weather conditions limit farmers' ability to adjust supply, leading to significant price swings for crops.

Policy Design:

For policymakers, PES provides insights into the effectiveness of interventions like subsidies, price controls, and investments in infrastructure. For example, understanding supply elasticity helps governments predict how quickly producers can respond to new incentives. In renewable energy markets, subsidies for solar panel production can lead to rapid supply expansion in industries with elastic supply chains, accelerating the transition to sustainable energy.

Broader Implications of Supply Elasticity

The elasticity of supply affects the overall stability and efficiency of markets. In industries with elastic supply, producers can adapt to changing market conditions, ensuring steady prices and consistent availability. This adaptability supports economic growth, as businesses and consumers benefit from reduced volatility and greater predictability.

However, inelastic supply can lead to persistent challenges during periods of disruption. For example, global supply chain bottlenecks during the COVID-19 pandemic highlighted the vulnerabilities of industries with limited supply flexibility. Addressing these challenges requires investments in technology, infrastructure, and supply chain diversification to improve elasticity and resilience.

PES also plays a role in determining how industries evolve over time. Sectors with low elasticity may face higher risks during economic downturns, as producers struggle to adjust output in response to falling prices. Conversely, industries with high elasticity can quickly adapt to new opportunities, driving innovation and competitiveness.

Key Formula to Remember:

Where:

PES = Price Elasticity of Supply

ΔQs % = Percent Change in Quantity Supplied

ΔP % = Percent Change in Price

-

The formula for price elasticity of supply works because it measures how responsive the quantity supplied is to changes in price, reflecting producers’ ability to adjust output. Using percentage changes allows for consistent comparisons across different products and price levels. It captures the flexibility of producers—if supply rises sharply with price, the good is considered elastic; if it barely changes, it’s inelastic.

Example:

A bakery notices a 25% rise in the price of pastries due to increased demand during a local festival. If the bakery increases production by 50% using existing resources, the PES is 2, showing elastic supply. Conversely, if output rises only 10% due to capacity constraints, the PES is 0.4, indicating inelastic supply.

Key Graphs to Remember:

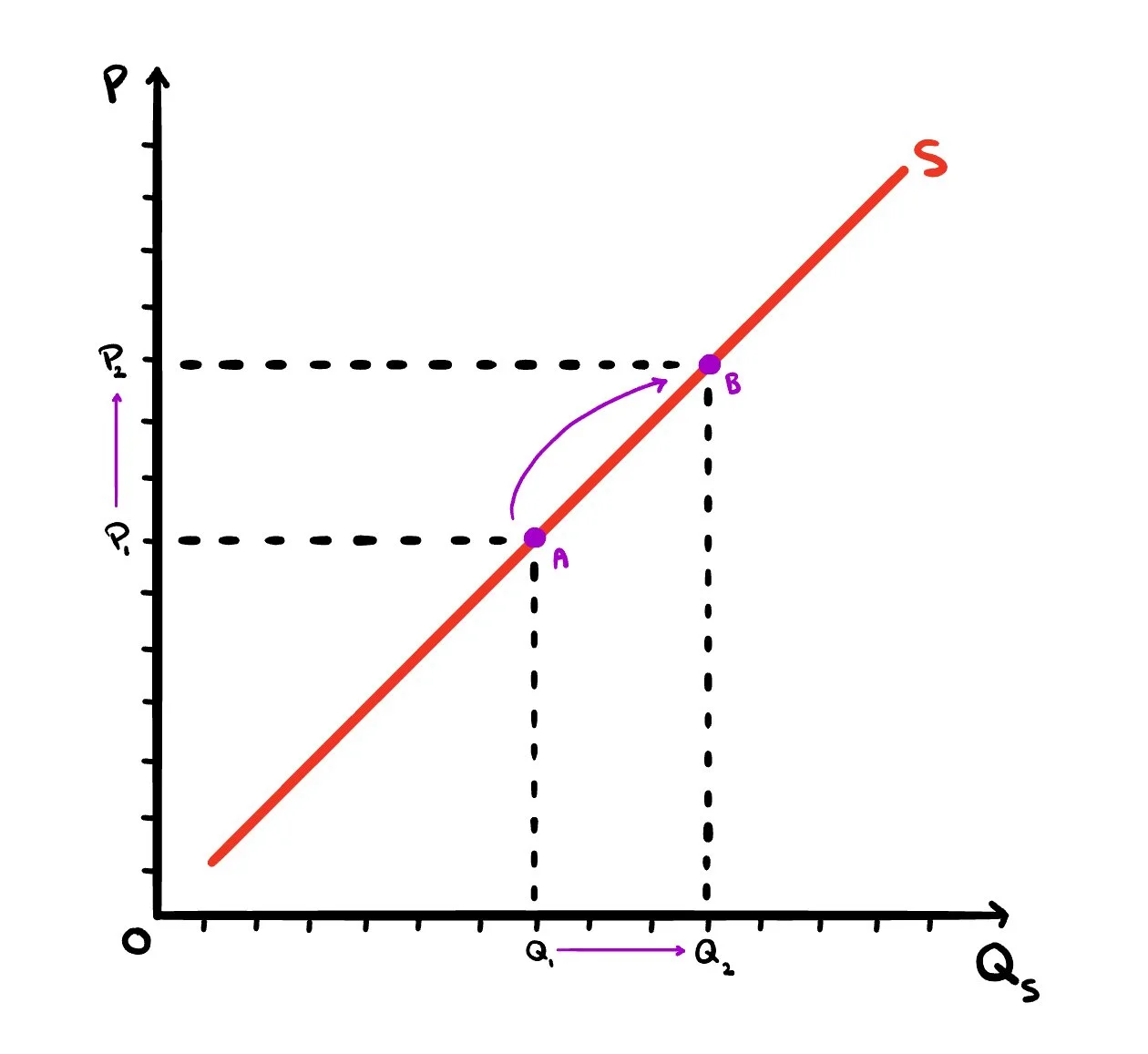

Figure 1. Unitary elastic supply curve

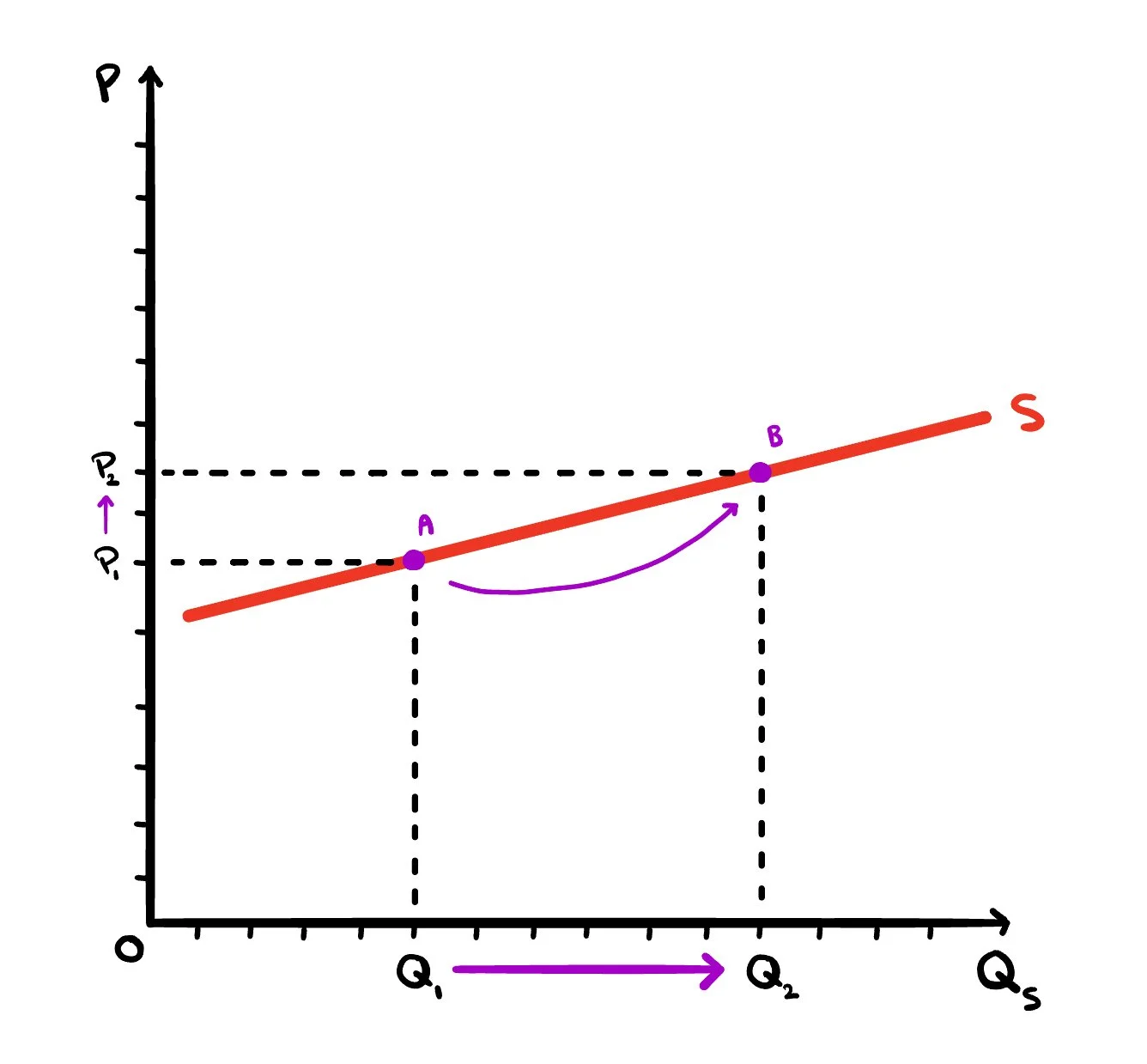

Figure 2. Elastic supply curve

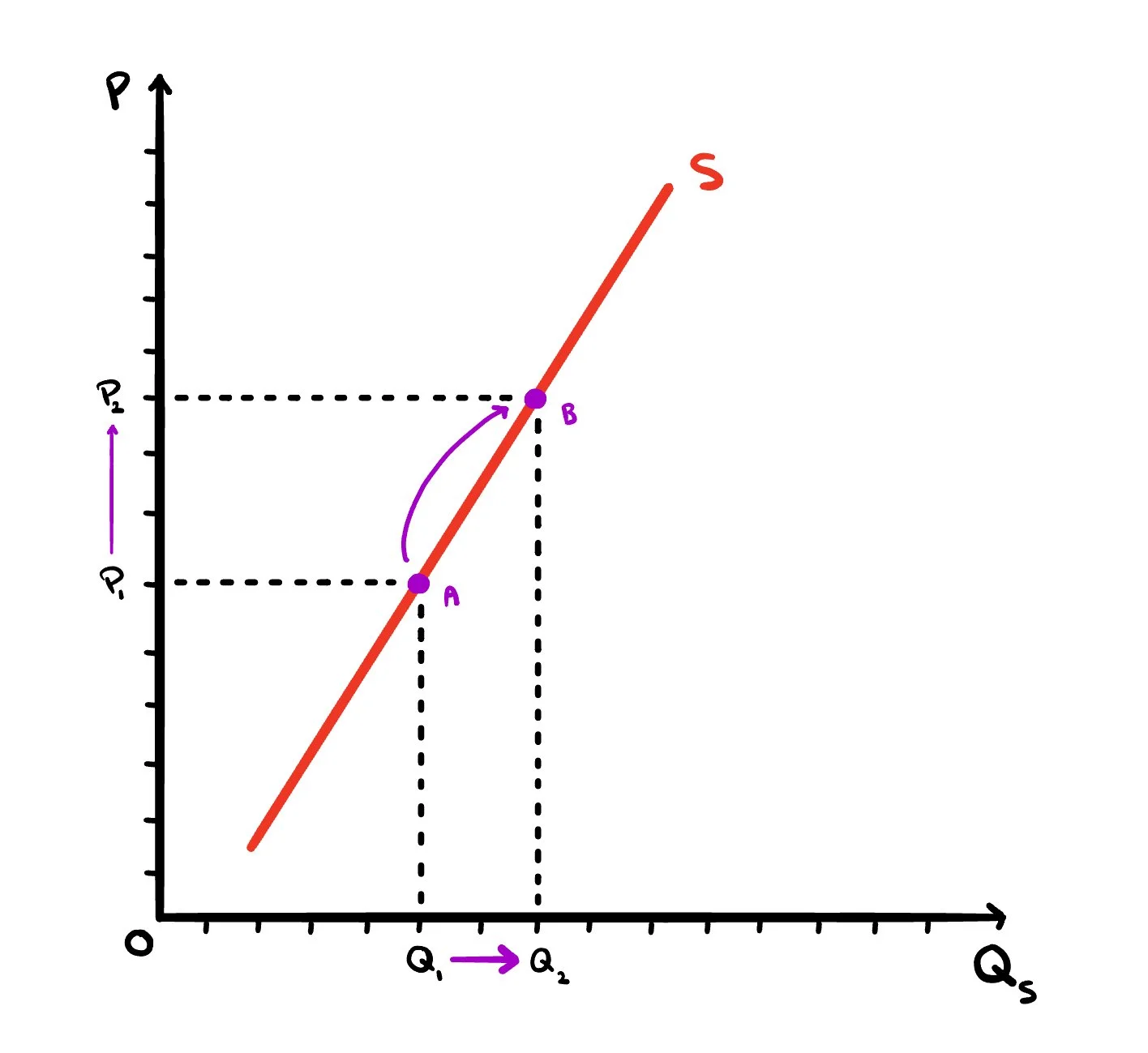

Figure 3. Inelastic Supply curve

-

These three graphs compare how different types of price elasticity of supply respond to a change in price from P₁ to P₂. In all diagrams, price increases and the quantity supplied responds accordingly. However, the magnitude of that response depends on how easily and quickly producers can adjust output, which is the essence of price elasticity of supply (PES). The flatter the curve, the more elastic the supply; the steeper the curve, the more inelastic it is. This is crucial for understanding how markets respond to shocks and for making production or policy decisions.

Figure 1: Unitary Elastic Supply

In the first graph, the supply curve is moderately sloped, showing unitary elasticity, meaning the percentage change in quantity supplied is exactly equal to the percentage change in price. As price rises from P₁ to P₂, the quantity supplied increases from Q₁ to Q₂ by the same proportion. This behavior suggests that firms can scale their output at a rate proportional to price changes, perhaps due to adaptable production capacity or flexible inputs.

Key points:

PES = 1

Price ↑ → Quantity ↑ by same %

Balanced and proportional supply response

Moderate slope on the supply curve

Figure 2: Elastic Supply

The second graph shows a relatively flat supply curve, indicating that supply is elastic. When price rises from P₁ to P₂, the quantity supplied increases sharply from Q₁ to Q₂, more than proportionally. This typically occurs in industries with plenty of spare capacity, abundant inputs, or rapid production adjustments. Sellers can quickly respond to price incentives by producing much more.

Key points:

PES > 1

Price ↑ → Quantity ↑ sharply

Supply is very responsive to price

Curve is relatively flat

Figure 3: Inelastic Supply

The third graph depicts a steep supply curve, which means supply is inelastic. Here, a price increase from P₁ to P₂ results in only a small increase in quantity from Q₁ to Q₂. This happens when firms face constraints—such as fixed capacity, scarce resources, or time lags—limiting their ability to scale up production quickly.

Key points:

PES < 1

Price ↑ → Quantity ↑ slightly

Limited supply flexibility

Steep slope on the curve

In Summary:

Price elasticity of supply measures how responsive producers are to changes in price, offering critical insights into market adaptability and production dynamics. By understanding PES, businesses can optimize production strategies, capitalize on market opportunities, and address supply-side constraints. Policymakers can use PES to design effective interventions that stabilize markets and promote long-term growth. As markets continue to evolve, supply elasticity remains a vital factor in ensuring economic resilience and efficiency.

Example:

A car manufacturer observes a spike in demand for electric vehicles after a government subsidy is announced. With elastic supply supported by advanced robotics, the company quickly scales production to meet demand, gaining a competitive edge.

Example:

During a drought, the supply of wheat becomes inelastic as farmers cannot increase production despite rising prices. This results in sharp price increases, impacting both producers and consumers.

Example:

A government offers subsidies for wind turbine manufacturing to meet renewable energy targets. Companies with elastic supply chains quickly ramp up production, ensuring sufficient supply to support the initiative.